Cryptocurrency mixer and/or splitter services serve no valid “real-world” ethical business use case considering the relevant FinTech and legal options open. Even in the very rare case when you are a refugee fleeing a financially abusive government regime or terrorist organization is seeking to steal your assets while the national currency is failing, like in Venezuela which I wrote about in my 2014 article; that is about political revolution and your personal safety more than anything else. Although cases like this give a valid reason why you might want to mix and/or split your crypto assets – that’s not fully the same use case we’re talking about here with the recent uptick of crypto mixer and/or splitter service use. It’s only fair that we discuss the most likely and common use case, which is trending up, and not the few rare edge cases. This use case would be fraud and money laundering.

The evidence does not support that a regular crypto exchange is the same thing as a mixer and/or splitter service. For definitions sake, I am not defining mixing and/or splitting cryptocurrency as the same thing as selling, buying, or converting it – all of this can be done on one or more of the crypto exchanges which is why they are called exchanges. If they are the same or even considerably similar, then why are people and orgs using the mixer and/or splitter services at all? They use them because they offer a considerably different service. Using a mixer and/or splitter services assumes you have gotten some crypto beforehand, from a separate exchange, a step or more before in the daisy chain. This can be done via legal or illegal means. Moreover, why are they paying repeated and hugely excessive fees for these services? The fees are out of line with anything possibly comparable because there is higher compliance and legal risk for the operators of them in that they could get sanctioned like Blender.IO and others.

You can still have privacy if that is what you are seeking via a semblance of legal moves such as a trust tied to a separate legal entity, family office entity, converting to real estate, and marriage entity – if you have time to do the paperwork. Legally savvy people have anonymity over their assets often to avoid fraudsters, sales reps, and just privacy for privacy’s sake – but again still not the same use case. Even when people/orgs use these legal instruments for privacy, they still have compliance reporting and tax obligations – I.E., some disclosure. Keep in mind some disclosure serves to protect you that you in fact own the assets you say you own. Using these legal instruments with the right technical security including an encrypted VPN and multifactor authentication serves to sustain privacy, and you will then not need a crypto mixer and/or splitter.

Yet if you had cryptocurrency and wanted strong privacy to protect your assets, why would you not at least use some of the aforementioned legal instruments or the like? Mostly because any attorney worth anything would be obligated to report this blatant suspected fraud, and would not want to tarnish their name on the filings, etc. Specifically, the attorney would have to see and know where and what entities the crypto was coming from and going to, under what contexts, and that could trigger them to report or refuse to work with them – I.E. a fraudster would want to avoid getting detected.

Specifically, the use of multiple legal entities in different countries in a daisy chain of crypto coin mixing and/or splitting tends to be the pattern for persistent fraud and money laundering. That was the case in the $4.5-billion-dollar crypto theft out of NY and in Blender mixing fraud, and many other cases.

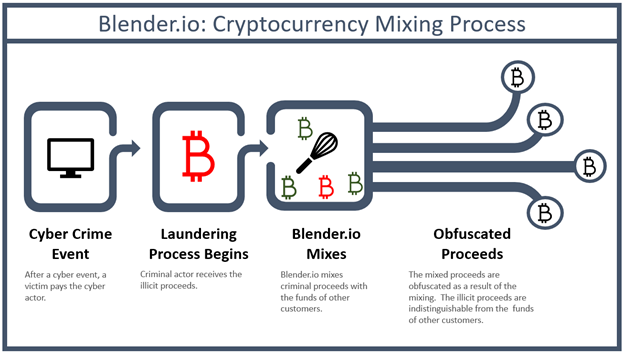

A recent U.S. Treasury press release concerning mixer service money laundering described it this way:

- “Blended.io (Blender) is a virtual currency mixer that operates on the Bitcoin blockchain and indiscriminately facilitates illicit transactions by obfuscating their origin, destination, and counterparties. Blender receives a variety of transactions and mixes them together before transmitting them to their ultimate destinations. While the purported purpose is to increase privacy, mixers like Blender are commonly used by illicit actors. Blender has helped transfer more than $500 million worth of Bitcoin since its creation in 2017. Blender was used in the laundering process for DPRK’s Axie Infinity heist, processing over $20.5 million in illicit proceeds”.

The question we as a society should be thinking about is tech ethics. What design feature crosses the line to enable fraud too much such that it is not pursued? For example, Silk Road crossed the line, selling illegal drugs, extortion, and other crime. Hacker networks cross the line when they breach companies and steal their credit card data and put it for sale on the dark web. Facebook crossed the line when it enabled bias and undue favor to impact policy outcomes.

Crypto mixer and/or splitter services (not mere crypto exchanges) are about as close to “money laundering as a service” as it gets – relative to anything else technically available excluding the dark web where there are far worse things available technically. Obviously, the developers, product owners, and project managers behind the crypto mixer and/or splitter services like this are serving the fraud and money laundering use case more than anything else. Some semblance of the organized crime rings is very likely giving them money and direction to this end.

If you are for and use mixer and/or splitter services then you run the risk of having your digital assets mixed with dirty digital assets, you have extortion high fees, you have zero customer service, no regulatory protection, no decedent Terms of Service and/or Privacy Policy if any, and you have no guarantee that it will even work the way you think it will.

In fact, you have so much decentralized “so-called” privacy that it could work against you. For example, imagine you pay the high fees to mix and split your crypto multiple times, and then your crypto is stolen by one of the mixing and/or splitting services. This is likely because they know many of their customers are committing fraud and money laundering, yet even if they are not these platforms are associated with that. Therefore, if the platform operators steal their crypto in this process, the victims have little incentive to speak up. Moreover, the mixing and/or splitting service companies have a nice cover to steal it, privacy. They won’t admit that they stole it but will say something like “everything is private and so we can’t see or know but you are responsible for what private assets you have or don’t have”. They will say something like “stealing it is impossible” which is course is a complete lie.

In sum, what reason do you have to trust a crypto mixing and/or splitting service with your digital assets as outlined above as they are hardly incentivized to protect them or you and operate in the shadows of antiquated non-western fintech regulation. So, what really do you get besides likely fraud? What is the business rationale behind using these services as outlined above considering no solid argument or evidence can support it is privacy alone, and what net benefit do you get besides business-enabling money laundering and fraud?

Now there are valid use cases for crypto and blockchain generally and here are five of them:

- Innovative tech removing the central bank for peer-to-peer exchange that is faster and more global, especially helping the underbanked countries.

- Smart contracts can be built on blockchain.

- Blockchain can be used for crowdfunding.

- Blockchain can be used for decentralized storage.

- The traditional cash and coin supply chain is burdensomely wasteful, costly, dirty, and counterfeiting is a real issue. Why do you need to carry ten dollars in quarters or a wad of twenty-dollar bills or even have that be a nation’s economic backing in today’s tech world?

Here are six tips to identify crypto-related scams:

- With most businesses, it should be easy to find out who the key operators are. If you can’t find out who is running a cryptocurrency or exchange via LinkedIn, Medium, Twitter, a website, or the like be very cautious.

- Whether in cash or cryptocurrency, any business opportunity promising free money is likely to be fake. If it sounds too good to be true it likely is. Multi-level marketing is one old example of this scam.

- Never mix online dating and investment/financial advice. If you meet someone on a dating site or social media app, and then they want to show you how to invest in crypto or they ask you to send them crypto. No matter what sob story and huge return they are claiming it’s a scam (FTC).

- Watch out for scammers who pretend to be celebrities who can multiply any cryptocurrency you send them. If you click on an unexpected link they send or send cryptocurrency to a so-called celebrity’s QR code, that money will go straight to a scammer, and it’ll be gone. Celebrities don’t have time to contact random people on social media, but they are easily impersonated (FTC).

- Celebrities are however used to pump crypto prices via social media, so they get a windfall, and everyone else takes a hit. Watch out for crypto like Dogecoin which is heavily tied to celebrity pumps with no real-world business value. If you are lucky enough to get ahead, get out then.

- Watch out for scammers who make big claims without details, white papers, filings, or explanations at all. No matter what the investment, find out how it works and ask questions about where your money is going. Honest investment managers or advisors want to share that information and will back it up with details in many documents and filings (FTC).

Jeremy Swenson is a disruptive thinking security entrepreneur, futurist/researcher, and senior management tech risk consultant. Over 17 years he has held progressive roles at many banks, insurance companies, retailers, healthcare orgs, and even governments including being a member of the Federal Reserve Secure Payment Task Force. Organizations relish in his ability to bridge gaps and flesh out hidden risk management solutions while at the same time improving processes. He is a frequent speaker, published writer, podcaster, and even does some pro bono consulting in these areas. As a futurist, his writings on digital currency, the Target data breach, and Google combining Google + video chat with Google Hangouts video chat have been validated by many. He holds an MBA from St. Mary’s University of MN, a MSST (Master of Science in Security Technologies) degree from the University of Minnesota, and a BA in political science from the University of Wisconsin Eau Claire.